#HSA Advantage

Explore tagged Tumblr posts

Note

I want to FIRE! Do you have any tips for that ;)

Hi love! While I'm not committed to their FIRE movement per se, here are some of my best tips to set yourself up for financial success:

Diligently keep track of your income and expenses. Audit every week or month to give yourself an honest look at your financial activity

Create financial goals and a realistic budget to help you achieve them

Prioritize saving up a 6-month emergency fund, maxing out your Roth IRA (or backdoor Roth IRA) and HSA account (if in the U.S.)

Purchase high-quality, timeless items that are built to last; It's cheaper in the long run to maintain items vs. constantly repurchasing items if you have the option

Create multiple sources of income: A 9-5 job, investments, side hustle, digital products, etc. Find ways to monetize activities you would enjoy doing without earning a dime

Focus on building a strong network and high-value, transferable skills: Even if you plan on working as an employee forever (no shame in that – it's a great way to get a steady paycheck), always strategize your career in a way that would leave you equipped to make it on your own. You need to be in the driver's seat of your career and financial life at all times

Make food at home, take care of your health, and take advantage of preventative medical testing, screenings, and procedures. Losing your health (physical and mental) is the easiest way to ruin your life satisfaction and your finances

Hope this helps xx

#finance#moneymindset#financial planning#savings tips#personal investments#female entrepreneurs#femme fatale#dark femininity#dark feminine energy#successhabits#success mindset#goal setting#it girl#queen energy#dream girl#female excellence#female power#femmefatalevibe#fire movement

76 notes

·

View notes

Text

HSA- Kuroki Date

Byeol-Bit -@terrovaniadorm

Hourglass Station academy -@fumikomiyasaki

Finally a Tokustasu Character

Name: Kuroki Date

Codename: Dangerous Zombie

Former Stage Name: Peony

Based on: Kuroto Dan and Poppy Pipopopo from Kamen Rider Exaid

Age: 18-21 when he died originally

𝗚𝗲𝗻𝗱𝗲𝗿:Male

𝗕𝗶𝗿𝘁𝗵𝗱𝗮𝘆: November 20

𝗦𝘁𝗮𝗿𝘀𝗶𝗴𝗻: Scorpio

𝗛𝗲𝗶𝗴𝗵𝘁: 177cm , 5’ 10

𝗘𝘆𝗲 𝗰𝗼𝗹𝗼𝗿: hetrochromia one Blue and one Red, he had green and Yellow eyes when he was Alive

𝗛𝗮𝗶𝗿 𝗰𝗼𝗹𝗼𝗿: black and White, Pink when he was Alive

𝗣𝗥𝗢𝗙𝗙𝗘𝗦𝗦𝗜𝗢𝗡𝗔𝗟 Status

Dorm: Syncrean

𝗦𝗰𝗵𝗼𝗼𝗹 𝘆𝗲𝗮𝗿: 2nd

𝗖𝗹𝗮𝘀𝘀: 2-E

𝗢𝗰𝗰𝘂𝗽𝗮𝘁𝗶𝗼𝗻: Student

𝗖𝗹𝘂𝗯: Video Game

𝗕𝗲𝘀𝘁 𝘀𝘂𝗯𝗷𝗲𝗰𝘁: Homeland: Fuujin City “ ( Onigashima)

Sexuality: Fluid .

𝗙𝗨𝗡 𝗙𝗔𝗖𝗧𝗦:

𝗗𝗼𝗺𝗶𝗻𝗮𝗻𝘁 𝗵𝗮𝗻𝗱: Right

𝗙𝗮𝘃𝗼𝗿𝗶𝘁𝗲 𝗳𝗼𝗼𝗱: Instant Ramen. And Candy

𝗟𝗲𝗮𝘀𝘁 𝗳𝗮𝘃𝗼𝗿𝗶𝘁𝗲 𝗳𝗼𝗼𝗱: meat that is. Literally Internal Organs

Likes: Idols , Cecilia in particular, Hacking , Video games, Sing and Karaoke

𝗗𝗶𝘀𝗹𝗶𝗸𝗲𝘀: Byeol- Bit ,His Intelligence and talents being insulted

𝗛𝗼𝗯𝗯𝘆: Video Games , Hacking , MEMEING ,singing and Dancing

��𝗮𝗹𝗲𝗻𝘁𝘀: Being able to make a Meme out himself, Due being a Pop star Before being Revived as a “Zombie” singing and Dancing, plotting Byeol- Bit’s Demise , Hacking

𝗣𝗘𝗥𝗦𝗢𝗡𝗔𝗟𝗜𝗧𝗬: Kuroki is a Very Eccentric and Mischievous individual on the Surface. On the Inside he is a Very Crafty, resourceful and Vengeful student often to the Point of being petty his Behavior is Pretty Erratic going from calm to psychopathic to straight silly .

Kuroki wasn't always this Weird he used to be at rather Cheery, Childish and Chipper popstar called Peony and wants Vengeance on the Person who took advantage of his Naivety to Torture and Kill him.

Unique Magic:

I’M God Himself

This is an almost Reality Bending Power ,any he says goes ….In its own Silly way. Like say Kuroki says Mythra will have an different Hairstyle today , it will happen in the most Ridiculous way Possible like having a Saw Cut it off to Mythra having an Afro due a Really bad hair day. His Unique Magic Treats everything like a Video Game.

Trivia

he can makes Clones of himself.

Kuroki being Dan Kuroto and Poppy Pipopopo is a Roundabout Reference of how Kuroto and Poppy are Connected in Exaid ,

Poppy Is the Bugster who Infected Kuroto’s Mother

Kuroki Reviving as a “ Zombie “ after someone Murdered him is Reference to Dan Kuroto revived as Bugster after being Murdered by Parad.

The Person who Murdered him was Byeol-Bit and He's Been trying to get Evidence in secret to be able to accuse her. Though he has looked into other Culprits but he only Remembers they had Pink hair like him and atrocious makeup .

He was Revived by his Dad as a “Zombie”

Kuroki Status as a “Zombie “ is more of A Digital existence called a Bug he often Gets Punished or Pranked by being Trapped in a Arcade ,phone Or computer .When under Stress or hurt he Game overs Respawn via Mario Pipe .

Kuroki Says he Has 9999x Lives so he's pretty Lax.

However,that Also means Kuroki can Interact with the World differently making him Important on Information gathering Mission . He also programs and tests Alot of the tech in Syncrean .

People think that Kuroki is Kuro’s Original owner but Both have said no to these claims.

He once Shoved a Thumb drive Up his.... let's not talk about that .

Voice Claims Oda Nobukatsu

youtube

Theme Song: Wish in the Dark

youtube

#kamen rider#kamen rider ex aid#twisted oc#disney twst#twisted wonderland#dan kuroto#disney twisted wonderland

9 notes

·

View notes

Text

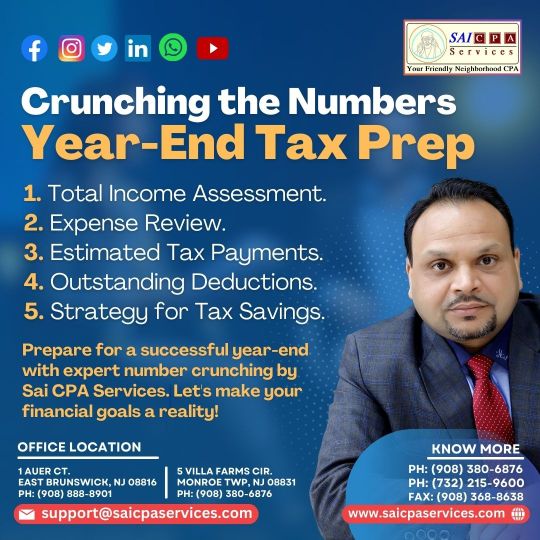

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

5 Ways For Small Business Owners To Reduce Their Taxable Income

Taxes can be anxious for a small business owner. You wear multiple hats, and one of the last things you want to do is give more of your hard-earned business profits to the nation.

Fortunately, there are many tax savings methods to reduce your taxable liability as a business owner. If you need methods to reduce your taxable income, consider some of the following ways below.

Employ a Family Member

The most suitable way to reduce taxes for your small business is by hiring one of your family members. The Internal Revenue Service allows for a variety of opportunities, all with the potential advantage of sheltering income from taxes. You can even hire your kids.

By hiring family members, small business owners can pay a lower marginal rate, or eliminate the tax on the income paid to their kids.

It is crucial to point out that earnings need to come from justified business goals. The IRS also lets small business owners have the benefit of reducing their taxes by hiring a spouse.

Depending on the advantages they may have through another job, you can even put aside retirement savings for them.

Start a Retirement Plan

As a small business owner, you give up a 401(k) contest compared to an employer. However, different retirement account options maximize retirement savings and reap valuable tax benefits. There are a variety of different retirement plan opportunities for business owners on the IRS website as a tax savings strategy.

Save Money for Healthcare Needs

One of the best methods to reduce small business taxes is by setting aside money for healthcare necessities. Medical costs continue to grow, and while you may be healthy now, saving money for unpredictable or future healthcare needs is crucial.

You can complete this through a Health Savings Account if you have a qualified high-deductible health plan.

By using HSAs, the business, and the employees can decrease taxes and potentially associated medical expenses.

Change Your Business Structure

As a small business owner, you do not have the advantage of an employer paying a part of your taxes. You are on the hook for the whole amount of Social Security and Medicare taxes.

As a limited liability company if your business is taxed you have to pay those taxes, though in distinctive circumstances you can eliminate half of those two tax responsibilities.

While there are different things to consider in this switch, like paying yourself adequate pay and other risks, it is a good way to reduce your taxable responsibility.

Deduct Travel Expenses

If you travel so much, you can reduce your business taxes. Business travel is completely deductible, though individual travel does not enjoy the same benefit. However, to maximize their business travel, small business owners can mix individual journeys with a justifiable business strategy.

With smart business tax planning, you can decrease your taxable revenue as a small business owner and maintain more of your funds operating for you. Just remember to consult a tax expert to assure you qualify for the possible savings.

2 notes

·

View notes

Text

Early Retirement Planning: What You Need to Know to Retire Comfortably

Retiring early is a dream for many, offering the freedom to enjoy life without financial stress. However, achieving this goal requires careful planning, disciplined saving, and strategic investment. Early retirement can become financially challenging rather than liberating without the right approach. Here’s what you need to know to retire comfortably before the traditional retirement age.

Defining Your Early Retirement Goals

Before you start planning, define what early retirement means to you. Some people envision stopping work entirely by their 40s or 50s, while others prefer a semi-retirement lifestyle, working part-time or pursuing passion projects.

Consider the lifestyle you want in retirement. Will you travel frequently, relocate to a lower-cost area, or maintain your current standard of living? Your answers will determine how much you need to save and invest. Use retirement calculators to estimate future expenses, considering inflation and unexpected costs. A clear vision of retirement will guide your financial strategy and help you set realistic savings targets.

Building a Strong Financial Foundation

The key to early retirement is financial independence, meaning your savings and investments generate enough income to cover your expenses. Achieving this requires a strong financial foundation.

Reduce Debt – High-interest debt, such as credit card balances and personal loans, can drain your savings. Paying off these obligations early ensures more of your income goes toward retirement investments. Mortgage debt should also be evaluated—owning your home outright can reduce future expenses.

Increase Savings Rate – While the traditional retirement savings rule suggests saving 15% of your income, early retirees must save 30-50% or more. Maximize contributions to tax-advantaged accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs). A high savings rate accelerates your financial independence.

Establish an Emergency Fund – A well-funded emergency account prevents you from dipping into retirement savings for unexpected expenses. Aim for 6-12 months' living expenses in a liquid account.

Investing Wisely for Long-Term Growth

A wise investment strategy is essential since early retirees need their savings to last longer. You must balance risk and growth to ensure your money continues working for you.

Diversified Portfolio – Invest in a mix of stocks, bonds, and real estate to reduce risk and maximize returns. Stocks offer high growth potential but can be volatile, so consider a diversified index fund strategy.

Tax-Efficient Investing – Early retirees must navigate tax-efficient withdrawals. Roth IRAs allow tax-free withdrawals, while taxable brokerage accounts offer flexibility before reaching traditional retirement age. Consider tax penalties for early 401(k) withdrawals unless using strategies like the Rule of 55 or a Roth conversion ladder.

Passive Income Streams – Investments that generate consistent income, such as dividend stocks, rental properties, or annuities, can support your retirement without depleting principal savings. Passive income reduces reliance on portfolio withdrawals, providing stability in down markets.

Healthcare and Insurance Considerations

One major challenge for early retirees is healthcare. Without employer-sponsored insurance, you must find affordable coverage until you qualify for Medicare at age 65.

Health Insurance Options – Private health insurance, Affordable Care Act (ACA) marketplace plans, or a spouse’s employer-sponsored plan may be necessary. HSAs are valuable for covering medical costs tax-free in retirement.

Long-Term Care Planning – Long-term care costs can become significant as life expectancy increases. Consider long-term care insurance or self-funding strategies to protect your assets from medical expenses later in life.

Sustainable Withdrawal Strategies

Withdrawing funds too quickly can lead to financial shortfalls, while withdrawing too conservatively may limit your lifestyle. A well-planned withdrawal strategy ensures your savings last.

The 4% Rule – A standard guideline suggests withdrawing 4% of your portfolio annually for a sustainable income stream. However, early retirees may need to adjust for longer retirement horizons.

Dynamic Withdrawals – Adjust withdrawals based on market conditions rather than sticking to a fixed percentage. During strong years, withdraw slightly more, and in downturns, reduce spending to preserve capital.

Side Income or Part-Time Work – Some early retirees generate extra income through consulting, freelancing, or small businesses. Even modest earnings can significantly extend your savings.

Early retirement is achievable with careful planning, disciplined saving, and strategic investing. You can enjoy financial independence and a comfortable retirement by defining clear goals, building a strong economic foundation, investing wisely, securing healthcare coverage, and implementing a sustainable withdrawal strategy. Whether you want to travel the world, start a new hobby, or enjoy more time with family, the right approach to early retirement will help you achieve your dream lifestyle.

0 notes

Text

5 Quick Tax Planning Tips for Houston Residents

Tax planning doesn’t have to be stressful. With a little preparation and strategy, you can save money and avoid common tax pitfalls. As a Houston resident, you benefit from unique local opportunities, but also face challenges like high property taxes and federal compliance. Here are five actionable tips to make tax season smoother and more efficient.

1. Take Advantage of Texas’ No Income Tax

One of the perks of living in Houston is Texas’ lack of a state income tax. However, this means your federal income taxes require extra attention. Ensure you’re maximizing deductions such as:

Mortgage interest.

Charitable contributions.

Education expenses.

By carefully documenting these deductions, you can significantly reduce your taxable income.

2. Maximize Property Tax Deductions

Houston residents often deal with high property taxes. If you’re a homeowner, make sure to:

Keep records of property tax payments.

Claim deductions for any home office or rental property expenses.

Investigate property tax exemptions, such as the homestead exemption, which can reduce your tax liability.

3. Contribute to Retirement Accounts

Boost your tax savings while planning for the future by contributing to retirement accounts. Consider:

401(k): Contributions are tax-deferred, reducing your taxable income.

IRA: Depending on your income, contributions may be tax-deductible.

Health Savings Accounts (HSAs): If you have a high-deductible health plan, HSAs offer triple tax benefits: contributions are deductible, growth is tax-free, and withdrawals for medical expenses are tax-free.

4. Stay Organized with Tax Records

Disorganization can cost you both time and money. Create a system to keep track of:

W-2s and 1099s for income reporting.

Receipts for deductible expenses, such as charitable donations or medical costs.

Records of investments for calculating capital gains or losses.

Staying organized throughout the year will save you stress when tax season arrives.

5. Hire a Professional Tax Planner

Taxes can get complicated, especially with federal requirements and potential audits. A professional tax planner can:

Help you identify deductions and credits you may not know about.

Ensure compliance with federal and local regulations.

Develop a personalized tax strategy tailored to your financial goals.

Get Expert Tax Planning Help

For professional tax planning in Houston, visit Criterion Biz. Our team specializes in helping Houston residents and businesses save time and money during tax season.

Learn more about expert tax services tailored for Houston residents and businesses: Click here.

1 note

·

View note

Text

How to Save More Money for Retirement Outside of Pension and 457(b) Plans

Planning for a secure retirement requires a multifaceted approach, especially when looking beyond traditional pension plans and 457(b) accounts. As a financial advisor with over 28 years of experience, I've guided many individuals in Florida toward achieving their retirement goals through diversified strategies. In this guide, we'll explore various methods to enhance your retirement savings, providing practical examples to illustrate each approach.

1. Maximize Contributions to Tax-Advantaged Accounts

Options to Consider:

Traditional IRAs: Tax-deferred growth with taxes paid upon withdrawal.

Roth IRAs: Tax-free growth since contributions are made after-tax.

Contribution Limits (2025):

Under 50: $6,500 annually

50 and older: $7,500 annually

Example:

Sarah, a 45-year-old Florida teacher, contributes $6,500 yearly to a Roth IRA.

With a 6% annual return over 20 years, her account could grow to $238,000, tax-free.

2. Utilize a Health Savings Account (HSA)

Key Benefits:

Triple Tax Advantage:

Contributions are tax-deductible.

Growth is tax-free.

Withdrawals for qualified medical expenses are tax-free.

Example:

John, 50, contributes the family maximum of $8,300 annually.

After 15 years at a 5% annual return, his HSA could grow to $165,000, which can cover medical costs in retirement.

3. Invest in Taxable Brokerage Accounts

Why Choose Brokerage Accounts?

Unlimited Contributions: No caps like retirement accounts.

Diverse Investment Options: Includes stocks, bonds, mutual funds, and ETFs.

Example:

Emily invests $10,000 yearly in a diversified portfolio.

Over 20 years, assuming a 7% annual return, her account could reach $424,000.

4. Explore Real Estate Investments

Benefits of Real Estate:

Steady Income: Passive rental income.

Appreciation Potential: Real estate values often rise over time.

Example:

Mike buys a $300,000 rental property in Miami, paying 20% down.

He nets $1,200 monthly in rental income. After 15 years, the mortgage is paid off, and the property appreciates to $450,000.

5. Leverage Employer-Sponsored Plans Beyond 457(b)

Consider These Options:

401(k) and 403(b) Plans: Take advantage of employer matching.

Example:

Lisa’s employer offers a 5% 401(k) match.

She contributes $20,000 annually, and her employer adds $1,000.

Over 25 years, with a 6% annual return, her savings grow to $1.2 million.

6. Delay Social Security Benefits

Key Advantage:

Increased Benefits: Delaying Social Security until age 70 increases monthly payments by about 8% per year.

Example:

Tom’s full retirement benefit is $2,000 monthly at 67.

By waiting until 70, his monthly benefit increases to $2,480, providing an extra $5,760 annually.

7. Start a Side Hustle or Part-Time Work

Benefits:

Additional Income: Keep earning while pursuing a passion.

Extra Investment Opportunities: Use the income to grow your retirement funds.

Example:

Maria, a retired teacher, earns $10,000 annually tutoring students part-time. She invests this extra income to boost her savings.

8. Follow a Tax-Efficient Withdrawal Strategy

Plan Your Withdrawals:

Withdraw from taxable accounts first, then tax-deferred, and finally tax-free accounts to minimize taxes.

Example:

David starts withdrawals from his taxable brokerage account, allowing his Roth IRA to grow tax-free and reducing his taxable income.

9. Review and Adjust Your Plan Regularly

Stay on Track:

Annual Check-Ins: Meet with a financial advisor to review your portfolio and adapt to changes.

Example:

Karen reviews her investment portfolio every year with her advisor, making adjustments based on market conditions and her goals.

Final Thoughts

By diversifying your retirement savings strategy, you can build a secure financial future. Whether through maximizing tax-advantaged accounts, investing in real estate, or leveraging a side hustle, every step brings you closer to a comfortable retirement.

For personalized guidance, contact David Kassir at Manna Wealth Management. With over 28 years of experience, we can help you tailor a plan that aligns with your goals and financial situation.

Secure your future today!

0 notes

Text

Low-Cost Health Insurance: Ultimate Guide to Affordable Coverage

1. What are the best options for low-cost health insurance? The best low-cost health insurance options include:

Medicaid: Free or low-cost coverage for eligible low-income individuals and families.

Health Insurance Marketplace Plans: Subsidized plans based on income and household size.

Short-Term Health Insurance: Temporary, affordable coverage for emergencies.

Employer-Sponsored Insurance: Often more affordable due to employer contributions.

Health Sharing Programs: Community-based sharing plans for medical expenses.

2. How can I qualify for subsidies to reduce my health insurance costs? To qualify for subsidies:

Your household income must be between 100% and 400% of the federal poverty level (FPL).

You must apply through the Health Insurance Marketplace.

You cannot have access to affordable health insurance through your employer. Subsidies include premium tax credits and cost-sharing reductions.

3. What are high-deductible health plans (HDHPs), and are they affordable? HDHPs are health insurance plans with lower monthly premiums but higher deductibles. They are affordable for those who:

Rarely visit the doctor or need medical care.

Pair the HDHP with a Health Savings Account (HSA) to save pre-tax money for medical expenses. HDHPs are best for healthy individuals or those looking to minimize upfront costs.

4. What strategies can help me save on health insurance premiums? To save on premiums:

Choose a plan with a higher deductible if your medical needs are low.

Take advantage of preventive care services covered at no cost under most plans.

Compare plans annually during open enrollment to find the best rates.

Look for family discounts or bundled insurance options.

Participate in wellness programs offered by some insurers for additional savings.

5. Are there any government programs that provide affordable health insurance? Yes, government programs include:

Medicaid: For low-income individuals and families, offering free or low-cost coverage.

CHIP (Children’s Health Insurance Program): For children in families that earn too much for Medicaid but cannot afford private insurance.

Medicare: For individuals aged 65+ or those with certain disabilities. These programs ensure access to affordable healthcare for eligible individuals.

#Affordable health insurance#Cheap health insurance plans#Low-cost family health insurance#Health insurance for low income#Affordable medical insurance#Best affordable health insurance

1 note

·

View note

Text

HSA OC - Kendall

Finally I don't Feel Guilty anymore about not using @fumikomiyasaki 's Raffle Prize , I'M FUCKING FREE THE weight I've Felt Is gone !! Now If Only I could just Get out of this creative rut I'm Thinking I might be reaching burnout.

Name: Kendall

Based on: Knuckles from Sonic

𝗚𝗲𝗻𝗱𝗲𝗿: Male

𝗔𝗴𝗲: 20

𝗕𝗶𝗿𝘁𝗵𝗱𝗮𝘆: October 18th

𝗦𝘁𝗮𝗿𝘀𝗶𝗴𝗻: Libra

𝗛𝗲𝗶𝗴𝗵𝘁: 185 cm

𝗘𝘆𝗲 𝗰𝗼𝗹𝗼𝗿: purple

𝗛𝗮𝗶𝗿 𝗰𝗼𝗹𝗼𝗿: Red

𝗣𝗥𝗢𝗙𝗙𝗘𝗦𝗦𝗜𝗢𝗡𝗔𝗟 𝗦𝗧𝗔𝗧𝗨𝗦

𝗗𝗼𝗿𝗺: Tetravania

𝗦𝗰𝗵𝗼𝗼𝗹 𝘆𝗲𝗮𝗿: 3rd Year

𝗖𝗹𝗮𝘀𝘀: 2-E

𝗢𝗰𝗰𝘂𝗽𝗮𝘁𝗶𝗼𝗻: Student

𝗖𝗹𝘂𝗯: Botany, Fighting Club

𝗕𝗲𝘀𝘁 𝘀𝘂𝗯𝗷𝗲𝗰𝘁: Gym

Homeland: Unknown he seems to be A long time friend of Soren

Sexuality: Fluid

.

𝗙𝗨𝗡 𝗙𝗔𝗖𝗧𝗦:

𝗗𝗼𝗺𝗶𝗻𝗮𝗻𝘁 𝗵𝗮𝗻𝗱: Right

𝗙𝗮𝘃𝗼𝗿𝗶𝘁𝗲 𝗳𝗼𝗼𝗱: grapes

𝗟𝗲𝗮𝘀𝘁 𝗳𝗮𝘃𝗼𝗿𝗶𝘁𝗲 𝗳𝗼𝗼𝗱: Most Fast food makes him sick

Likes: Please Leave him alone, martial Arts, nature , Treasure Hunting , Quiet, Western films

𝗗𝗶𝘀𝗹𝗶𝗸𝗲𝘀: Any time people acknowledge he dose Care about Soren , Artificial Light , big Cities , Being Tricked , Erwin( Agrees with. Him on some of the Things Soren dose but not everything), Roxanne go away

𝗛𝗼𝗯𝗯𝘆: Hangliding, Collecting Gemstones

𝗧𝗮𝗹𝗲𝗻𝘁𝘀: Parkour, Hangliding

𝗣𝗘𝗥𝗦𝗢𝗡𝗔𝗟𝗜𝗧𝗬:

Kendall is A Pretty Stubborn, brash and Hot blooh, echidna Beastman , A Long Time Friends of Soren , who unlike Mark is not Easily influenced by Soren they kinda Balance out in a Way , that Still didn't Stop Soren Getting Expelled ,

Kendall Tried but failed to try Mediate between Erwin and Soren way before Thier Relationship got to that Critical point , they Both Didn't Listen To what he had to say , and if They did could've prevented the Crisis in the First place .In Kendall's Words.

Kendall is often Perceived in as Dumb ,He's not Really a Dumb Muscle head just Naive , due to being in an isolated Tribe His whole life so he's Often really gullible but dosent like When people Take advantage of that Gullibility… Besides Soren only because Of most of the time he's knows he's just Being Soren.

However Kendall's Biggest Fault is his Arrogance and being overly Serious which he's Based on Knuckles it's as Funny as you think .

Unique Magic

Powe Palm

enhance his Already Tremendous Strength. It almost Looks as if he has Super speed but it actually Just his Strength .

Trivia:

Modern Lingo and Slang are .. foreign to him .

Soren Please stop teaching Kendall Modern Slang without telling this man where and How to use it.

Roxanne …. I'm so Sorry Kendall

He can be A Meathead but only if he dosent Get something.

Has an older Sister based On Tikal

He doesn't not know his own Strength he's Going to crush your Hands if you don't tell him to Watch it

He doesn't doesn't understand Text Speak Soren is still teaching him ..

Has Inosuke Syndrome , Pretty face Buff as hell body.

Voice claim:

Movie!Knuckles

Theme Song: Unknown From Me

#twisted wonderland#disney twisted wonderland#twisted wonderland oc#twst oc#twisted oc#disney twst#twst fandorm#fandorm#Kendall

11 notes

·

View notes

Text

Understanding Financial Advisor Duties and Responsibilities

Financial advisors play an essential role in helping individuals and businesses navigate the complexities of financial planning. They offer professional guidance to manage wealth, achieve financial goals, and make informed decisions. This blog explores the key duties and responsibilities of financial advisors to help you understand their critical contributions to financial well-being.

Key Duties and Responsibilities of Financial Advisors

1. Assessing Client’s Financial Needs

One of the primary responsibilities of a financial advisor is to evaluate a client’s current financial situation. This involves:

Analyzing income, expenses, assets, and liabilities.

Identifying financial goals, such as retirement, homeownership, or education savings.

Understanding risk tolerance and investment preferences.

By creating a clear financial snapshot, advisors can tailor strategies that align with a client’s objectives.

2. Developing Customized Financial Plans

Based on a thorough assessment, financial advisors design personalized plans to meet client goals. These plans may include:

Budgeting strategies to control expenses.

Savings and investment recommendations.

Retirement planning, including 401(k) or IRA contributions.

Insurance policies to mitigate financial risks.

A well-crafted plan serves as a roadmap, guiding clients through significant life decisions.

3. Investment Portfolio Management

Financial advisors often manage investment portfolios on behalf of their clients. This responsibility involves:

Researching market trends and identifying lucrative opportunities.

Diversifying investments to minimize risk.

Monitoring portfolio performance and making necessary adjustments.

Their expertise ensures that clients’ investments align with both short-term and long-term objectives.

4. Providing Tax Optimization Strategies

Minimizing tax liabilities is another critical function of financial advisors. They:

Recommend tax-efficient investment vehicles, such as municipal bonds.

Advise on tax-advantaged accounts, like HSAs or 529 plans.

Coordinate with tax professionals to optimize annual filings.

Efficient tax planning can enhance overall financial growth and protect client assets.

5. Guiding Retirement Planning

Retirement is a significant milestone, and financial advisors ensure clients are adequately prepared. This includes:

Estimating future income needs.

Selecting suitable retirement savings accounts.

Advising on Social Security benefits and pension plans.

By planning ahead, clients can enjoy a secure and stress-free retirement.

6. Educating Clients About Financial Literacy

Empowering clients with knowledge is an often-overlooked responsibility of financial advisors. They:

Explain complex financial concepts in simple terms.

Offer insights on market behavior and economic trends.

Help clients understand the risks and rewards of different strategies.

Education fosters confidence, enabling clients to actively participate in their financial journey.

7. Adhering to Ethical and Legal Standards

Financial advisors have a fiduciary duty to prioritize their clients' interests. This involves:

Providing transparent and unbiased advice.

Avoiding conflicts of interest.

Complying with regulations and industry standards.

Trust and integrity are the cornerstones of a successful client-advisor relationship.

Why Work With a Financial Advisor?

Partnering with a financial advisor can simplify the complexities of managing wealth and help you achieve peace of mind. Whether you need guidance on investments, retirement, or tax planning, their expertise can transform your financial outlook.

If you’re searching for expert advice, Vantage Financial Partners is a trusted resource for personalized financial solutions. Their team’s commitment to excellence ensures that every client’s unique needs are met with precision and care.

Conclusion

The duties and responsibilities of financial advisors extend far beyond managing money. They act as strategic partners, educators, and advocates, ensuring their clients’ financial health and success. By understanding these roles, you can better appreciate the value they bring to your financial journey.

#top rated financial planning firm#wealth management consultant#senior wealth advisor in wisconsin#529 college savings plan#fiduciary financial planner#educational savings plan#best financial advisors in wisconsin#college savings plan#financial planner in wisconsin#529 plan

0 notes

Text

Unlocking Medical Insurance: Essential Billing Insights Every Patient Should Know

unlocking Medical Insurance: Essential Billing Insights Every Patient Should Know

Unlocking Medical Insurance: Essential Billing Insights Every Patient Should Know

Navigating the complexities of medical insurance can frequently enough feel overwhelming. With various plans, hidden costs, and complex billing processes, understanding your healthcare coverage can seem daunting. In this comprehensive guide, we will explore essential billing insights that every patient should know to unlock the full potential of their medical insurance. From understanding common terms to practical tips for effective communication with your healthcare provider, we’ll cover everything you need to know.

Understanding the Basics of Medical Insurance Billing

Before diving into the nuances of medical insurance billing, let’s understand some fundamental concepts:

Premium: This is a monthly fee you pay for your health insurance coverage.

Deductible: The amount you need to pay out-of-pocket before your insurance starts covering costs.

Copayment (Copay): A fixed amount you pay for specific services, such as doctor visits and prescriptions.

Coinsurance: The percentage of costs you pay after meeting your deductible.

Network: A group of healthcare providers who have a contract with your insurance company.

The Importance of Understanding Your Medical Bills

Medical bills can be confusing, but they are crucial for understanding your healthcare expenses. Familiarizing yourself with these documents will allow you to:

Identify potential billing errors.

Understand what your insurance covers.

Plan for future healthcare costs.

Common Billing Errors and How to Spot Them

Billing errors can occur, and it’s essential to know how to identify them. Common mistakes include:

Duplicate charges for the same service.

Incorrect billing codes.

Billing for services not performed.

Benefits of Proactive Communication with Your Healthcare Provider

One of the most effective ways to manage your medical insurance billing is through open communication with your healthcare provider. Here are some benefits:

Greater clarity on what services are covered by your insurance.

The chance to negotiate costs before receiving services.

Understanding potential out-of-pocket expenses.

Practical Tips for Open Communication

Ask for a detailed estimate before procedures.

confirm that your provider is in-network.

Request clarity on terms you do not understand.

Case Study: Real-life Example of Navigating Medical Bills

To illustrate the importance of understanding medical billing, consider the following case study:

Case Study: Sarah’s Experience

Sarah underwent knee surgery and received a confusing medical bill. By reviewing her bill and contacting her healthcare provider, she discovered:

A duplicate charge for physical therapy sessions.

Misclassified billing codes that inflated her costs.

After addressing these errors, Sarah saved over $1,500, highlighting the importance of vigilance in medical billing.

maximizing Your Insurance Benefits

Knowing how to maximize your insurance benefits can definitely help you save significant amounts on healthcare. Here are some tips:

Regularly review your benefits and coverage details.

Take advantage of preventive care services that often have no cost-share.

Utilize healthcare savings accounts (HSAs) to reduce taxable income and cover medical expenses.

Navigating Appeals Process for Denied Claims

If your insurance claim is denied, it can be frustrating. Understanding how to navigate the appeals process effectively can be beneficial. here’s a simple guide:

Read the denial letter carefully to understand the reason for denial.

Gather supporting documents, including medical records and billing statements.

Submit a formal appeal with a clear, concise argument.

Follow up regularly to ensure your appeal is being processed.

Table: Common Reasons for Claim Denial

Reason for Denial

How to Avoid

Provider out-of-network

Confirm provider network status before services.

Incorrect coding

Request clarity on billing codes from the provider.

Missing facts

Ensure all documentation is submitted and complete.

Staying Informed: Resources for Patients

To help you stay informed and proactive in managing your medical insurance, consider the following resources:

HealthCare.gov – Understand insurance options and regulations.

Centers for Medicare & Medicaid Services – Information on Medicare and Medicaid.

State Insurance Commissions – Resources for state-specific insurance issues.

conclusion

Understanding medical insurance billing dose not have to be a daunting task.By familiarizing yourself with essential billing insights, fostering communication with healthcare providers, and staying proactive about your insurance benefits, you can unlock a world of potential savings and gain greater control over your healthcare expenses. With the right information and tools, you can navigate the medical billing landscape with ease, ensuring you receive the care you deserve without breaking the bank.

youtube

https://medicalbillingcertificationprograms.org/unlocking-medical-insurance-essential-billing-insights-every-patient-should-know/

0 notes

Text

How to Save on Health Insurance Premiums for Senior Citizens: Tips & Strategies

Health insurance for senior citizens can often be a financial burden, but there are several strategies available to reduce premiums while still maintaining comprehensive coverage. As medical costs continue to rise, seniors need to explore all available options to ensure they get the best value for their money. Here are some effective tips and strategies for saving on health insurance premiums for senior citizens.

1. Consider Medicare Advantage Plans

For those eligible for Medicare, one of the best ways to reduce premiums is by choosing a Medicare Advantage Plan (Part C). These plans, offered by private insurers, often have lower premiums than traditional Medicare (Parts A and B), and they may provide additional coverage, including vision, dental, and prescription drugs. Many Medicare Advantage Plans have zero-dollar premiums or very low monthly costs, making them a cost-effective alternative.

2. Opt for High Deductible Plans

Another strategy to save on health insurance for senior citizens is to consider high-deductible health plans (HDHPs). These plans usually have lower monthly premiums but require you to pay more out-of-pocket for medical expenses before insurance kicks in. HDHPs are an excellent choice for seniors who don’t anticipate frequent doctor visits or who are generally healthy. Additionally, HDHPs can be paired with a Health Savings Account (HSA), which allows seniors to set aside money tax-free to cover future medical expenses.

3. Shop Around and Compare Plans

When selecting health insurance for senior citizens, it’s important to shop around and compare plans. Premiums, coverage, and out-of-pocket costs can vary significantly between providers. Tools like the Health Insurance Marketplace or the Medicare website can help seniors compare different plans based on their specific needs and location. Don't settle for the first plan you come across—taking the time to compare options can result in significant savings.

4. Look for Discounts and Subsidies

Many health insurance providers offer discounts for specific groups, including seniors. Some Medicare Advantage Plans and Medigap policies offer discounts based on income or medical conditions. Seniors should check with their insurer or the Medicare.gov website to see if they qualify for any subsidies or financial assistance programs. These programs can help reduce premiums, co-pays, and deductibles.

5. Maintain a Healthy Lifestyle

A healthy lifestyle can help reduce the need for expensive medical care and lower overall insurance costs. Seniors who maintain a balanced diet, exercise regularly, and avoid smoking and excessive alcohol consumption are often rewarded with lower insurance premiums. Insurance companies may offer discounts to policyholders who demonstrate a commitment to health and wellness. Additionally, staying healthy can prevent the need for costly treatments and medications, helping to reduce out-of-pocket expenses in the long run.

6. Review Your Plan Annually

Health needs change over time, and so do health insurance for senior citizens plans. It’s crucial to review your health insurance coverage annually, especially during open enrollment periods, to ensure it still meets your needs. Seniors may find that they no longer need certain benefits or that their premiums have increased. By reevaluating your plan each year, you can potentially find more affordable options or adjust coverage to better suit your changing health situation.

Conclusion

Saving on health insurance premiums is possible for senior citizens with careful planning and smart decision-making. By exploring Medicare Advantage plans, opting for high-deductible health plans, comparing different providers, seeking discounts, maintaining a healthy lifestyle, and reviewing coverage annually, seniors can keep their insurance premiums under control. Remember, the best plan is one that balances affordable costs with the necessary coverage, ensuring both financial savings and health security.

0 notes

Text

Tax-Efficient Financial Planning: Maximize Your Savings

Tax efficiency is a critical aspect of financial planning that can significantly increase your savings. It involves understanding tax-advantaged accounts, such as IRAs, 401(k), and HSAs, as well as leveraging deductions and credits.

Strategic financial planning aligns your investments and spending to minimize taxes while maximizing returns. Proactive planning ensures you take advantage of available opportunities, leaving you with more funds to allocate toward your goals.

Reduce your tax burden effortlessly! Download the app for personalized tax-efficient financial planning strategies.

0 notes

Text

Affordable Teeth Implants: Expert Care You Can Trust

Dental health plays a crucial role in our overall well-being, affecting not only our physical health but also our self-confidence and quality of life. Missing teeth can hinder our ability to speak clearly, chew effectively, and smile confidently. While solutions like dentures and bridges have existed for years, dental implants have become the gold standard in modern dentistry for replacing missing teeth. Yet, for many, the question remains: Are dental implants affordable? The answer is a resounding yes. This article explores the benefits, cost considerations, and reasons why dental implants might be the ideal solution for you.

What Are Dental Implants?

Dental implants are artificial tooth roots made of biocompatible materials like titanium, which are surgically inserted into the jawbone. They provide a sturdy foundation for fixed or removable replacement teeth designed to match your natural teeth in appearance and function. Unlike traditional dentures, implants fuse with the bone through a process called osseointegration, making them a permanent and reliable solution.

Key Components of a Dental Implant:

Implant Post: The titanium screw that is surgically placed into the jawbone.

Abutment: A connector that holds the crown to the implant post.

Crown: The visible part of the implant that resembles a natural tooth.

Why Choose Dental Implants?

Dental implants are highly popular due to their many advantages:

1. Natural Appearance and Functionality

Implants are designed to look, feel, and function like your natural teeth. They restore full chewing power, allowing you to enjoy your favorite foods without restrictions.

2. Long-Lasting Solution

With proper care, dental implants can last a lifetime. This makes them a more cost-effective solution compared to dentures and bridges, which may need replacement every few years.

3. Improved Oral Health

Dental implants preserve the jawbone and prevent bone loss, a common issue with missing teeth. They also help maintain the structure of your face and prevent sagging.

4. Convenience

Unlike dentures, which require adhesives and daily maintenance, implants are a permanent solution that integrates seamlessly with your natural teeth.

5. Boosted Confidence

A complete, healthy smile can improve your self-esteem, allowing you to speak and smile with confidence.

Are Dental Implants Affordable?

Affordability is a primary concern for many individuals considering dental implants. While implants are typically more expensive upfront than other tooth replacement options, their long-term benefits often outweigh the initial costs. Here’s why:

1. One-Time Investment

Unlike dentures and bridges, which may need frequent adjustments or replacements, implants are a one-time investment that can last a lifetime.

2. Reduced Maintenance Costs

Implants do not require special cleaning solutions, adhesives, or frequent dental visits for adjustments, reducing overall maintenance costs.

3. Financing Options

Many dental practices offer financing plans, allowing you to pay for your implants in manageable monthly installments.

4. Insurance Coverage

While not all insurance plans cover dental implants, some may cover a portion of the procedure. Additionally, flexible spending accounts (FSAs) or health savings accounts (HSAs) can be used to offset costs.

Factors Affecting the Cost of Dental Implants

The cost of dental implants can vary depending on several factors:

1. Number of Implants Needed

The more implants you require, the higher the overall cost. Single-tooth implants are generally more affordable than full-mouth restorations.

2. Geographic Location

Prices may vary based on the location of your dental practice. Urban areas may have higher costs compared to rural locations.

3. Bone Grafting or Sinus Lifts

If you have insufficient jawbone density, additional procedures like bone grafting or sinus lifts may be necessary, increasing the overall cost.

4. Material Quality

High-quality materials may cost more upfront but offer better durability and long-term benefits.

5. Experience of the Dentist

Experienced implant specialists may charge higher fees, but their expertise ensures better outcomes.

How to Make Dental Implants More Affordable

There are several ways to make dental implants more accessible and budget-friendly:

1. Consult Multiple Providers

Shop around and compare prices from different dental practices. Some clinics may offer competitive pricing or promotional discounts.

2. Ask About Payment Plans

Many dental practices provide in-house financing or partner with third-party lenders to offer flexible payment plans.

3. Consider Dental Schools

Dental schools often provide implant procedures at reduced rates, supervised by experienced professionals.

4. Utilize Insurance Benefits

Check with your insurance provider to see if they cover any part of the implant procedure. Even partial coverage can significantly reduce costs.

5. Travel for Affordable Care

Dental tourism has become popular, with countries like Mexico, India, and Thailand offering high-quality dental care at a fraction of the cost in the U.S.

The Implant Procedure: What to Expect

Understanding the implant process can help alleviate any concerns you might have. Here’s a step-by-step guide:

1. Initial Consultation

Your dentist will evaluate your oral health, take X-rays or 3D scans, and discuss your treatment plan.

2. Preparation

If necessary, preparatory procedures like tooth extraction or bone grafting will be performed.

3. Implant Placement

The implant post is surgically inserted into the jawbone under local anesthesia. Healing typically takes 3-6 months.

4. Abutment Placement

Once the implant has fused with the bone, the abutment is attached to the implant post.

5. Crown Placement

The final step involves placing the custom-made crown onto the abutment, completing your new tooth.

Choosing the Right Implant Specialist

Selecting a qualified and experienced dentist is crucial for a successful implant procedure. Here are some tips:

Check Credentials: Ensure the dentist is certified and has specialized training in implant dentistry.

Read Reviews: Look for testimonials from previous patients to gauge their satisfaction.

Ask About Technology: Advanced tools like 3D imaging and computer-guided surgery can enhance precision and outcomes.

Request Before-and-After Photos: Viewing the dentist’s work can give you confidence in their expertise.

Conclusion

Affordable teeth implants are not a myth; they’re a reality for those who explore their options and prioritize long-term benefits. While the upfront costs may seem daunting, the durability, functionality, and aesthetic appeal of dental implants make them a worthwhile investment. By choosing the right provider, utilizing financing options, and exploring alternative solutions, you can achieve a healthy, confident smile without breaking the bank.

Your smile is one of your most valuable assets. Don’t let missing teeth hold you back from living your best life. With expert care and thoughtful planning, affordable teeth implants can be within your reach.

0 notes

Text

Get Started with Stocks: A Conversation with AJ

Today, I want to share an insightful conversation I had with AJ on my podcast about stepping into the world of stocks. If you’ve been curious about investing but don’t know where to start, this one’s for you.

So, I asked AJ, "How would I get into stocks?" And here’s the simple roadmap he shared:

Step 1: Open a Brokerage Account

First things first, you need a brokerage account. AJ explained that if you’ve got an account with a major bank like Wells Fargo, Bank of America, or platforms like TD Ameritrade (his personal choice), you’re already on the right track. Now, he’s not promoting any specific service here—it’s just about having that brokerage account as your gateway to investing.

Step 2: Choose Stocks Based on Your Interests

One golden piece of advice from AJ: "Pick stocks based on what your interests are, not just market trends." This way, you’re investing in companies or industries you actually care about, which makes it easier to stay engaged and informed.

Step 3: Explore ETFs

Ever heard of ETFs (Exchange-Traded Funds)? They’re essentially a bundle of stocks wrapped into one convenient package. AJ described them as a great way to dip your toes into investing. Whether you’ve got a few dollars or a few hundred, you can start small and build your portfolio over time. Think of it like this: instead of buying a $100 Google stock, you could invest $4 into an ETF that includes Google and other companies.

Step 4: Educate Yourself

Education is key. AJ emphasized doing your homework and understanding what you’re investing in. He also highlighted two underrated tools for getting into finance:

- Your 401K: Many jobs offer investment options through 401Ks. Look into what’s available and take advantage of any employer matches.

- Health Savings Accounts (HSAs): These accounts not only help you save on taxes but also give you an opportunity to invest. It’s a win-win!

Final Thoughts

AJ’s advice highlighted that investing doesn’t have to be intimidating. Start small, stay curious, and invest in what aligns with your interests and goals. And don’t forget—your financial journey is personal. Take the time to learn, grow, and make informed decisions.

What about you? Are you already investing, or is this something you’re ready to dive into? Let’s keep the conversation going. Drop your thoughts, questions, or experiences in the comments. Let’s build wealth—the MonWell way Watch the FULL EPISODE:

youtube

0 notes

Text

Retirement Planning San Diego

Retirement planning San Diego is an essential aspect of financial security, especially in a city like San Diego, where the cost of living is high and the dream of a comfortable retirement is a common goal for many. Whether you’re starting your career or nearing retirement age, it’s important to have a solid plan in place to ensure you live comfortably without financial stress. San Diego offers a unique environment for retirement planning, blending its vibrant economy, beautiful surroundings, and diverse lifestyle options. Here’s a guide to help you navigate the key components of retirement planning in San Diego.

1. Understand Your Retirement Goals

The first step in retirement planning is setting clear and achievable goals. Consider factors like when you want to retire, the lifestyle you envision, and how much you need to live comfortably. San Diego offers a wide range of options, from coastal living to more suburban lifestyles, and your plan should reflect where you want to be. Factor in travel, hobbies, healthcare, and any other activities that will define your retirement.

2. Evaluate Your Current Financial Situation

Start by taking a close look at your finances. What are your current income, expenses, debts, and savings? San Diego’s high cost of living can make saving for retirement challenging, especially if you’re living in one of its more expensive neighborhoods like La Jolla or Del Mar. That’s why it’s crucial to track your spending and create a budget that prioritizes long-term savings, such as contributions to retirement accounts like 401(k)s, IRAs, or other investment vehicles.

3. Maximize Retirement Savings Plans

In San Diego, as elsewhere, contributing to retirement accounts is one of the best ways to secure a comfortable future. Consider maxing out your 401(k) if your employer offers a match — this is essentially free money. In addition, an IRA (Traditional or Roth) can help you build savings with tax advantages. San Diego residents often face higher-than-average costs for housing and living expenses, so it’s important to start saving early to account for these factors.

4. Plan for Healthcare Costs

Healthcare is a significant concern for retirees, and in San Diego, healthcare options are plentiful but expensive. Make sure to factor in health insurance premiums, Medicare, and any supplemental plans. The cost of healthcare is expected to rise, and being proactive in your planning will give you peace of mind as you approach retirement. Look into options like Health Savings Accounts (HSAs) to help with tax-free savings for medical expenses.

5. Invest Wisely for the Future

In addition to retirement accounts, it’s important to have a diverse investment portfolio that will grow over time. San Diego has a thriving real estate market, so some people choose to invest in rental properties as part of their retirement strategy. Others might prefer stocks, bonds, or mutual funds. The key is to balance risk and return based on your retirement timeline and goals.

6. Consider the Cost of Living in San Diego

Living in San Diego has its perks, but it can also come with a high price tag. The average home price in San Diego is well above the national average, and rent prices are similarly steep. When planning for retirement, factor in these living costs and make sure you have enough to cover both daily living expenses and future needs.

Conclusion

Retirement planning in San Diego requires careful consideration of your finances, goals, and the local economy. The city offers a variety of opportunities for those looking to retire in comfort, but you must plan ahead to ensure you have the resources to support your ideal lifestyle. By saving early, investing wisely, and considering the high cost of living, you can create a successful retirement plan that allows you to enjoy your golden years in this beautiful Southern California city.

CA LIC #0C71264, #0G81294 Investment advice offered through Copia Wealth Management Advisors, Inc. Copia Wealth Management Advisors, Inc. is a registered investment advisor.

0 notes